2024 Form IL-2210 Instructions

General Information

What is the purpose of this form?

Form IL-2210, Computation of Penalties for Individuals, allows you to figure penalties you may owe if you did not

- make timely estimated payments,

- pay the tax you owe by the original due date, or

- file a processable return by the extended due date.

Note: The late-payment penalty for underpayment of estimated tax is based on the tax shown due on your original return. Do not use the tax shown on an amended return filed after the extended due date of the return to compute your required installments in Step 2.

Do I need to complete this form if I owe penalties?

No, you do not need to complete this form if you owe penalties. We encourage you to let us figure your penalties and send you a bill instead of completing and filing this form yourself.

If you let us figure your penalties, complete your Form IL-1040 as usual, leave Line 34 on your Form IL-1040 blank, and do not attach Form IL-2210.

However, you must complete this form if you

- use the annualized income installment method in Step 6; or

- choose to enter the actual amount of tax withheld in each quarter in Step 2, Line 10a.

For more information, see Publication 103, Penalties and Interest for Illinois Taxes. To receive a copy of this publication, visit our website at tax.illinois.gov.

What is late-payment penalty?

Late-payment penalty is a penalty assessed for failure to pay the tax you owe by the due date. This penalty could result from two different underpayment situations and is assessed at either 2 percent or 10 percent of the unpaid liability based on the number of days the payment is late. The penalty rates used on this form are for returns due on or after January 1, 2005. For returns due before January 1, 2005, see Publication 103.

You will be assessed a late-payment penalty for unpaid tax if you did not pay the total tax you owe by the original due date of the return. An extension of time to file your return does not extend the amount of time you have to make your payment.

You will be assessed a late-payment penalty for underpayment of estimated tax if you were required to make estimated tax payments and failed to do so, or failed to pay the required amount by the payment due date.

You do not owe a late-payment penalty for underpayment of estimated tax if

- you qualify as a farmer for this year (check the box on Form IL-1040, Line 34a);

- you or your spouse were 65 years of age or older, and permanently lived in a nursing home during this year (check the box on Form IL-1040, Line 34b);

- you were not required to file Form IL-1040 for last year (check the box on Form IL-1040, Line 34d);

- last year’s Form IL-1040 had a zero tax liability (Form IL-1040, Line 14 minus Lines 15, 16, 17, 28, and 29); or

- this year’s tax liability (Form IL-1040, Line 14 minus Lines 15, 16, 17, 25, 27, 28, 29, and 30) is $1,000 or less.

What is late-filing or nonfiling penalty?

Late-filing or nonfiling penalty is a penalty assessed for failure to file a processable return by the extended due date. This penalty is the lesser of $250 or 2 percent of the tax amount required to be shown due on your return, reduced by withholding and payments made by the original due date and any credits allowed on your return (2024 Form IL-1040, Lines 15, 16, 17, 28, 29, and 30.)

An additional penalty will be assessed if you do not file a processable return within 30 days of the date we notify you that we are not able to process your return. This additional penalty is equal to the greater of $250 or 2 percent of the tax shown on your return, determined without regard to any payments and credits, and may be assessed up to a maximum of $5,000.

What if I underpaid my estimated tax because of a change in the law during the tax year?

If a change in the Illinois Income Tax Act (IITA) enacted during the tax year increased your liability and the new statute does not specifically provide for relief from penalties, you may reduce or eliminate your penalty for underpayment of estimated tax by using the annualized income installment method in Step 6 and computing your income and liability for each period according to the IITA as in effect as of the end of that period. See Specific Instructions for Step 6.

What if I need additional assistance or forms?

- Visit our website at tax.illinois.gov for assistance, forms or schedules.

- Write us at Illinois Department of Revenue, P.O. Box 19001, Springfield, Illinois 62794-9001.

- Call 1 800 732-8866 or 217 782-3336 (TTY, at 1 800 544-5304).

- Visit a taxpayer assistance office - 8:00 a.m. to 5:00 p.m. (Springfield office) and 8:30 a.m. to 5:00 p.m. (all other offices), Monday through Friday.

Specific Instructions

Step 1: Provide the following information

Follow the instructions on the form.

Step 2: Figure your required installments

Line 1 – Enter in Column A the total amount of income tax and compassionate use of medical cannabis and sale of assets by gaming licensee surcharges shown on your 2024 Form IL-1040, Lines 14 and 22. Enter in Column B the income tax and surcharges shown on your 2023 Form IL-1040, Lines 14 and 22.

Note: For Columns A and B, if a corrected return was filed for either year on or before the automatic six-month extension date, the corrected tax should be used. If an amended return was filed for either year after the automatic six-month extension date, use the most current tax reported prior to the extension date.

Line 2 – Enter in Column A the total amount of credits you claimed on your Form IL-1040, Lines 15, 16, 17, 28, 29, and 30 for this year. Enter in Column B the total amount of credits you claimed on your Form IL-1040, Lines 15, 16, 17, 28 and 29, for the prior tax year. Do not include your tax withheld or estimated payments on these lines.

Note: If you are filing a joint return this year and you and your spouse did not file a joint return last year, enter in Column B the total of the taxes shown on both of your Form IL-1040 returns for last year.

If you filed a joint return last year and you are either filing separate returns this year or filing a joint return with a different spouse, skip Lines 1 and 2 of Column B. Enter in Column B, Line 3, the following calculation:

Tax minus credits shown on last year’s joint return X Tax minus credits you would have shown on a separate return for last year ÷ Total of the taxes minus credits you and your spouse would have shown on separate returns for last year

Lines 3 through 6 and Line 8 – Follow the instructions on the form.

Line 7 – If Line 5 is $1,000 or less or if you checked the box on your Form IL-1040, Line 34a, 34b, or 34d indicating you are not required to make estimated tax payments, enter zero and skip to Step 3. Otherwise, follow the instructions on the form.

Note: We will waive the late-payment penalty for underpayment of estimated tax if you timely paid the lesser of 100 percent of the prior year’s tax liability or 90 percent of the current year’s tax liability. This form reflects that waiver.

Line 9a - For each quarter, enter the date that corresponds with the 15th day of the 4th, 6th, and 9th month of your tax year and the 15th day of the first month following the end of your tax year. If this date falls on a weekend or holiday, use the next business day.

Line 9b – Enter the amount of your required installment for each due date shown. For most taxpayers, this is the amount shown on Line 8. However, if you annualize your income, you must complete Step 6 to determine the amount of your required installment for each due date. For taxpayers who annualize, this is the amount shown on Step 6, Line 56.

Note: Annualized income installment method: If your income was not received evenly throughout the year, you may be able to lower or eliminate the amount of your required installments by using the annualized income installment method in Step 6. If you choose to annualize your income in Step 6, you must use this method for all four installments.

Line 10a – Quarters 1 through 4: Enter one-fourth of the total tax withheld (or the actual tax withheld from your wages for each quarter).

Note: We consider you to have paid Illinois tax withheld evenly over the entire year unless you send us copies of pay stubs or a letter from your employer that states the amounts actually withheld during each quarter. To figure even payments of tax withheld, divide the total amount withheld by four. If you file a joint return, include the tax withheld for both you and your spouse.

Line 10b – Quarters 1 through 4: Enter the amount of pass-through withholding made on your behalf and shown on Schedule K-1-P, Partner’s or Shareholder’s Share of Income, Deductions, Credits, and Recapture, or Schedule K-1-T, Beneficiary’s Share of Income and Deductions. Enter the entire amount in the quarter in which the pass-through entity’s tax year ended.

Lines 10c and 11 – Follow the instructions on the form.

Lines 12 and 13 – Complete Lines 12 and 13 of each quarter before proceeding to the next quarter. Follow the instructions on the form.

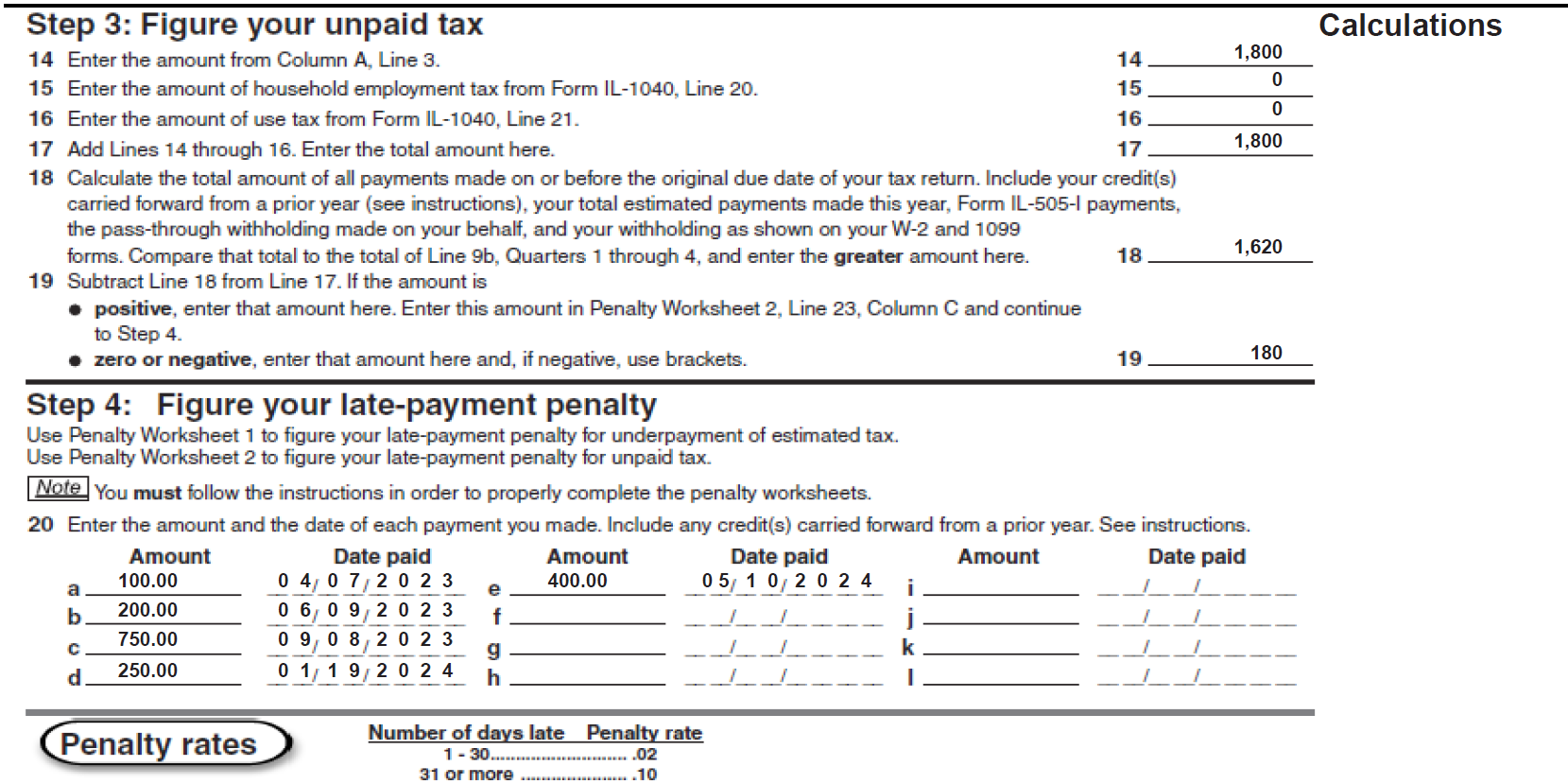

Step 3: Figure your unpaid tax

Lines 14 through 17 – Follow the instructions on the form.

Line 18 – Calculate the total of all payments made on or before the original due date of your 2024 return. Include

- any overpayment carried forward to 2024 from a prior year original or amended return if that prior year return was filed on or before the original due date of your 2024 Form IL-1040 (April 15, 2025, for calendar year filers),

- your Form IL-1040-ES and Form IL-505-I payments made this year,

- the pass-through withholding made on your behalf, and

- your withholding as shown on your W-2 and 1099 forms. Compare that total to the total of Line 9b, Quarters 1 through 4, and enter the greater amount here.

Line 19 – Subtract Line 18 from Line 17. If the amount is

- positive, enter the amount here. You owe a late-payment penalty for unpaid tax. Enter this amount in Penalty Worksheet 2, Line 23, Column C and continue to Step 4.

- zero or negative, Enter the amount here. If the result is negative use brackets. Continue to Step 4 and complete Penalty Worksheet 1.

Step 4: Figure your late-payment penalty

Use Penalty Worksheet 1 to figure your late-payment penalty for underpayment of estimated tax. Use Penalty Worksheet 2 to figure your late-payment penalty for unpaid tax.

Note: You must follow the instructions to properly complete the penalty worksheets.

Line 20 – Enter your payments, regardless of the type of payment, and the date you made the payment. List the payments in date order. Include any overpayment carried forward from a prior year original or amended return. If your prior year return that made the election to credit your overpayment against your 2024 tax was filed

- on or before the extended due date of that prior year return, your credit is considered to be paid on April 15, 2024. However, if all or a portion of your overpayment results from payments made after the original due date of your 2023 return, that portion of your credit is considered to be paid on the date you made the payment.

- after the extended due date of that prior year return, your credit is considered to be paid on the date you filed the return on which you made the election.

Do not include tax credits, pass-through withholding made on your behalf, or withholding.

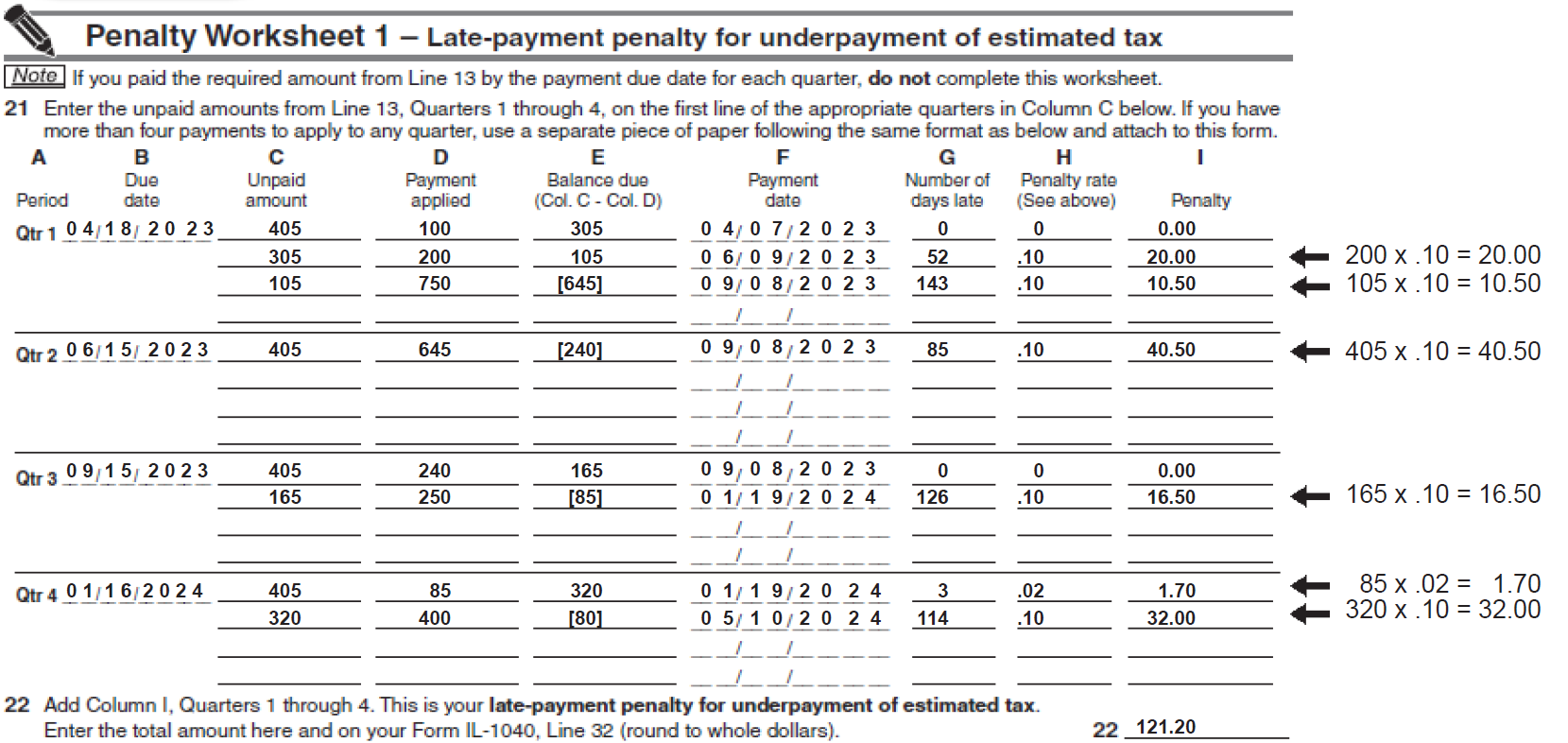

Penalty Worksheet 1 - Late-payment penalty for underpayment of estimated tax

If the amount on Line 13 is positive (greater than zero) for any quarter, you may owe a late-payment penalty for underpayment of estimated tax. Use this worksheet to figure the penalty for any unpaid quarter.

Note: If you paid the required amount from Line 13 by the due date in Step 2, Line 9a for each quarter, do not complete Penalty Worksheet 1.

Line 21 – Follow the instructions below for each column.

Column B - Enter in Quarters 1 through 4, the installment due date for each quarter from Step 2, Line 9a.

Column C - Enter the amounts from Step 2, Line 13, on the first line of Column C for each quarter.

Column D – Apply the payment with the earliest date from Line 20 to the first unpaid quarter. Complete Columns E through I. Continue applying payments in date order until all unpaid amounts in Column C have been satisfied (Column E is zero or has an overpayment for all unpaid quarters), or you have no more payments to apply. See the example at the end of these instructions.

Note: Penalty Worksheet 1 allows for up to four payments to be applied to any quarter. If you have more than four payments to apply to any quarter, use a separate piece of paper following the same format as Penalty Worksheet 1 and attach to your Form IL-2210.

Column E – Subtract the payment in Column D from the unpaid amount in Column C.

If the result is positive, complete Columns F through I. Enter this positive (unpaid) amount on the next line in Column C. Continue applying payments in date order until Column E is an overpayment, zero, or you have entered “0” in Column D.

If the result is negative or zero, you have paid this quarter. Enter the amount here and, if negative, use brackets. Complete Columns F through I. Apply any negative (overpayment) amount in Column E to the next underpaid quarter

Note: If this amount is negative in the fourth quarter, and the payment date in Column F is after the original due date of the return, apply this overpayment to any unpaid tax shown on Penalty Worksheet 2, Line 23 when figuring your late-payment penalty for unpaid tax. See the instructions for Penalty Worksheet 2, Column D. If you entered “0” in Column D, enter the amount from Column C here, and complete Columns F through I.

Column F – Enter the date the payment in Column D was made. If Column D is “0,” do not enter a date and skip to Column H.

Column G – Figure the number of days from the date in Column B to the date in Column F and enter that number here. This is the number of days the payment was late.

Column H – Enter the penalty rate that applies to the number of days you entered in Column G. See the penalty rates on Form IL-2210, Page 2. If Column D is “0,” enter 10 percent (.10) here.

Column I – Figure this amount using the payment portion in either Column C or Column D.

If Column D is “0” or if Column E is “0” or an overpayment, multiply the unpaid amount in Column C by the penalty rate in Column H. Otherwise, multiply the payment amount in Column D by the penalty rate in Column H. Enter the amount here.

Line 22 – Add Column I, Quarters 1 through 4. This is your late-payment penalty for underpayment of estimated tax. Enter the amount here and on your Form IL-1040, Line 34.

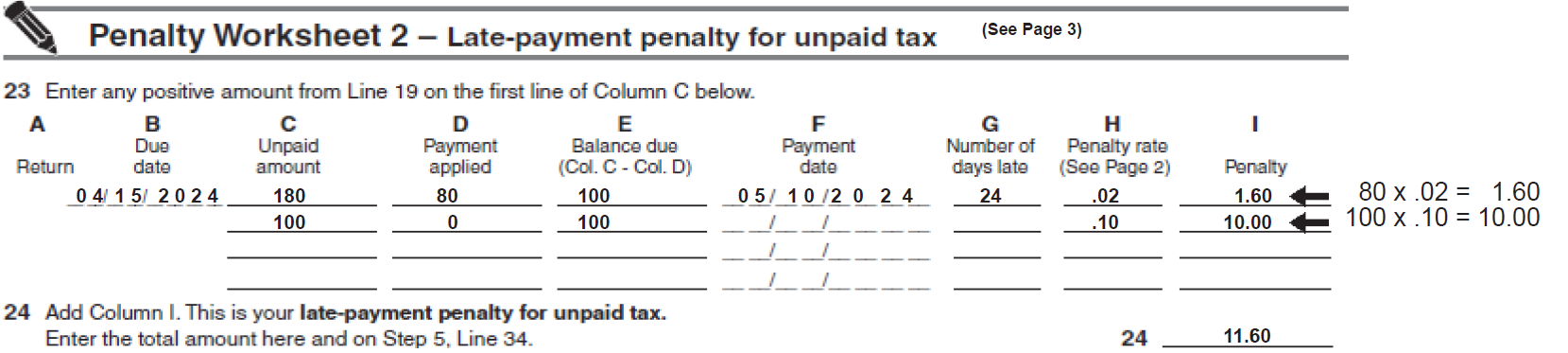

Penalty Worksheet 2 Late-payment penalty for unpaid tax

Line 23– Follow the instructions below for each column.

Column B – Enter the original due date of your return.

Column C – Enter any positive amount from Line 19 on the first line of Column C.

Column D – If you completed Penalty Worksheet 1 and you have a negative amount (overpayment) in the 4th quarter of Column E, and the payment date in Column F is after the original due date of your return, apply the overpayment from Line 21, Column E, as the first payment for Line 23, Column D, and complete Columns E through I.

Continue applying unused payments from Step 4, Line 20, in date order until the unpaid amount in Column C has been satisfied (Column E is zero or an overpayment), or you have no more payments to apply. See the example on Page 5.

If you have no more payments to apply and Column C remains unpaid, enter “0” in Column D, and complete Columns E through I.

Column E – Subtract the payment in Column D from the unpaid amount in Column C.

If the result is positive, complete Columns F through I. Enter this positive (unpaid) amount on the next line in Column C, and continue completing Columns D through I. Continue doing this until Column E is an overpayment, zero, or you have entered “0” in Column D.

If the result is negative or zero, you have paid your tax. Enter the amount here and, if negative, use brackets. Complete Columns F through I.

If you have entered “0” in Column D, enter the amount from Column C here, and complete Columns F through I.

Column F – Enter the date the payment in Column D was made. If

- you are applying an overpayment from Penalty Worksheet 1, Column E, enter the date that corresponds to that payment, shown on Line 20.

- Column D is “0,” do not enter a date and skip to Column H.

Column G – Figure the number of days from the date in Column B to the date in Column F and enter that number here. This is the number of days the payment was late.

Column H – Enter the penalty rate that applies to the number of days you entered in Column G. See the penalty rates on Form IL-2210, Page 2. If Column D is “0” and you did not enter a date in Column F, enter 10 percent (.10) here.

Column I – Figure this amount using the payment portion in either Column C or Column D.

If Column D is “0” or if Column E is “0” or an overpayment, multiply the unpaid amount in Column C by the penalty rate in Column H. Otherwise, multiply the payment amount in Column D by the penalty rate in Column H. Enter the amount here.

Line 24 – Add Column I. This is your late-payment penalty for unpaid tax. Enter this amount here and on Step 5, Line 34.

Step 5: Figure your late-filing penalty and the amount you owe

Figure your late-filing penalty

Complete Lines 25 through 33 to figure your late-filing penalty only if

- you are filing your Form IL-1040 after the extended due date of your return; and

- your tax was not paid by the original due date of your return.

Unless both of these apply, you do not owe a late-filing penalty.

Lines 25 through 33 – Follow the instructions on the form.

Figure the amount you owe

Lines 34 through 36 – Follow the instructions on the form.

Line 37 – Add Lines 34 through 36. Enter the total on this line. If the result is positive, this is the total of your tax, late-payment penalty for unpaid tax, and your late-filing penalty. See Form IL-1040, Line 40, instructions for your payment options.

Step 6: Complete the annualization worksheet for Step 2, Line 9b

Unless you made timely estimated payments, annualizing your income will usually not reduce your penalty. If you complete the annualization worksheet, check the box on your Form IL-1040, Line 34c, and attach Form IL-2210 to your return.

Complete Lines 38 through 56 of one column before going to the next, beginning with Column A.

If the IITA was amended during your tax year and changed how you compute your net income or credits, and the amendment does not provide relief for taxpayers who computed their estimated tax obligations following the old law, use the old law to compute your net income and credits for each period ending before the date the amendment became law.

For example, if a law passed on May 31, 2024, that disallowed certain deductions allowed under prior law, for tax years ending on or after July 31, 2024, and you are completing this form for calendar year 2024 you should compute the amounts in Columns A and B, Line 38 by treating the deduction as though no law changes were made. The amount in Columns C and D, Line 38 must be computed by adding back the deduction in accordance with the new law.

To figure the amount on Line 49 for a period before a new act became law, use the tax rates and credits under the old law.

For example, if a credit was repealed by law, effective June 30, 2023, for tax years ending on or after December 31, 2023, and the credit was reinstated July 30, 2024, for tax years ending on or after December 31, 2024, you could have used the credit to reduce the tax liability on your 2023 Form IL-2210, in Columns A and B, but not for Columns C and D.

The credit could be used again on the 2024 Form IL-2210, in Columns C and D, Line 49, but not Columns A and B. The credit may not be used for the first five months of the year, because the law restoring the credit was not in effect as of May 31, 2024.

Line 38 – In Columns A through C, enter the base income that you would have entered on Form IL-1040, Line 9, if you completed a Form IL-1040 for the first three months, the first five months, and the first eight months of the tax year. In Column D, enter the amount from your Form IL-1040, Line 9.

Income you received through a partnership, S corporation, trust, or estate is considered received on the last day of that entity’s tax year.

Nonresidents and part-year residents – Enter the amount in each column that you would have entered on Schedule NR, Step 5, Line 46, if you completed a Schedule NR at the end of each period.

Lines 39 and 40 – Follow the instructions on the form.

Line 41 – Enter the amount in each column that you would have entered as your exemption allowance on Form IL-1040, Line 10, as if you had completed a Form IL-1040 at the end of each period.

If your number of exemptions changed during the tax year, determine the exemption allowance that you were entitled to claim at the end of each period. Enter this amount in the appropriate column.

Nonresidents and part-year residents – Prorate your exemptions

as follows:

Exemption allowance (Form IL-1040, Line 10) x Illinois annualized income / Total annualized income

Line 42 – Follow the instructions on the form.

Line 43 – Multiply Line 42 by 4.95 percent (.0495).

Line 44 – Enter the amount of compassionate use of medical cannabis and sale of assets by gaming licensee surcharges you would have entered on Form IL-1040, Line 22, if you completed a Form IL-1040 for the first three months, the first five months, and the first eight months of the tax year. In Column D, enter the amount from your Form IL-1040, Line 22.

Lines 45 through 56 – Follow the instructions on the form.

Example

Penalty Peterson’s total income tax and compassionate use of medical cannabis and sale of assets by gaming licensee surcharges is $1,875 as shown on his 2024 Form IL-1040, Lines 14 and 22. His tax due for 2023 was $2,600. The total amount of his credits (Form IL-1040, Lines 15, 16, 17, 28, 29, and 30) for 2024 is $75. The total amount of his credits (Lines 15, 16, 17, 28, and 29) for 2023 was $250. No Illinois Income Tax was withheld from his pay nor did he have a credit from a prior year. He figured his penalty using the following estimated payments:

- $100 on April 7, 2024

- $200 on June 9, 2024

- $750 on September 8, 2024

- $250 on January 19, 2025

Mr. Peterson filed his return May 10, 2025, and paid $400.